By Betsy Finklea

A presentation on opportunity zones was made at a recent Dillon City Council meeting by a representative from the S.C. Department of Commerce.

Peggy McLean of the S.C. Department of Commerce gave the council information about what opportunity zones are, what the benefits are, and what the program is all about.

McLean said opportunity zones are a federal program not a state program and all rulings and regulations come from the U.S. Treasury Department or the IRS (Internal Revenue Service). She said this is not a grant program. The benefits derived are tax breaks to investors not grants.

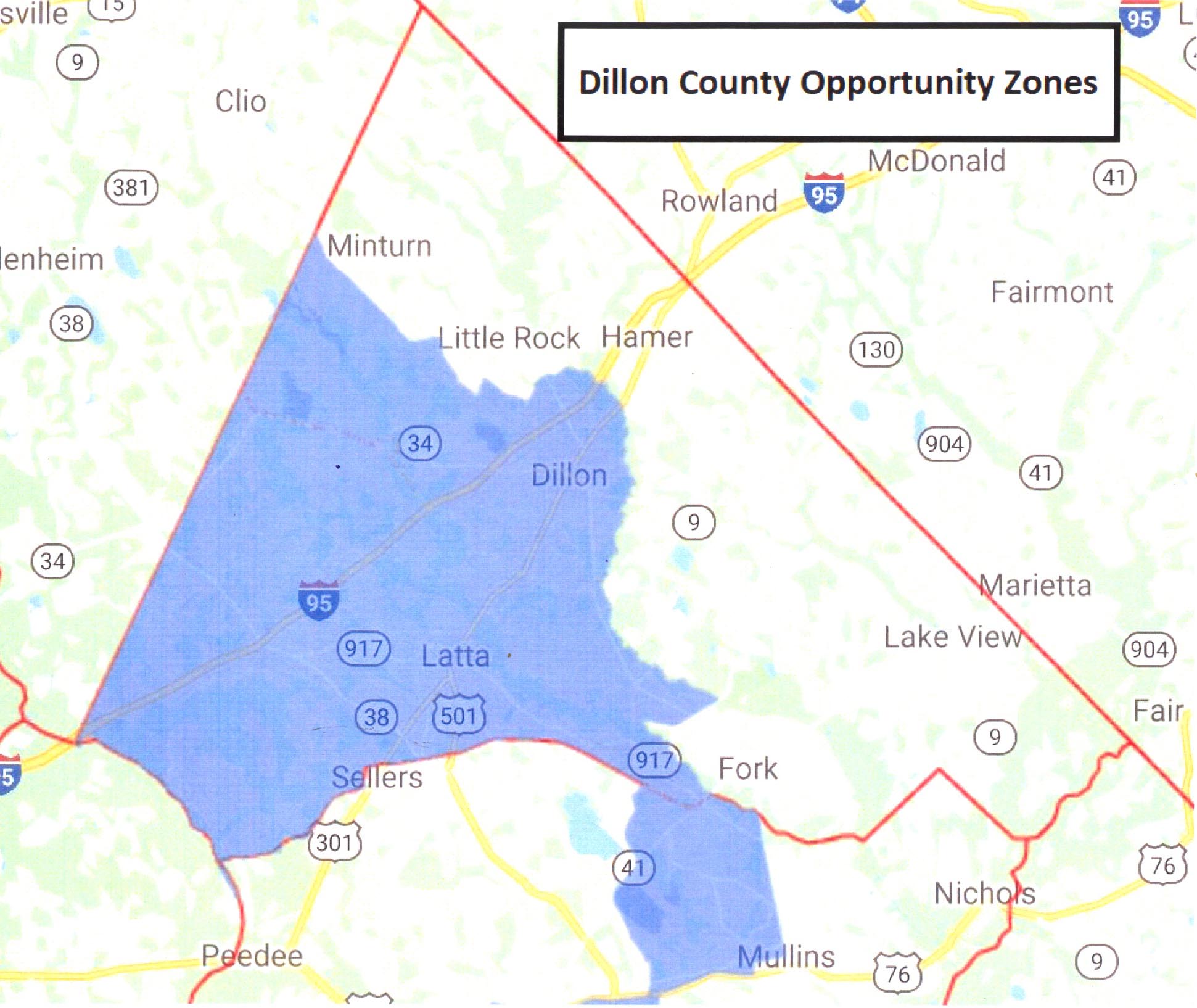

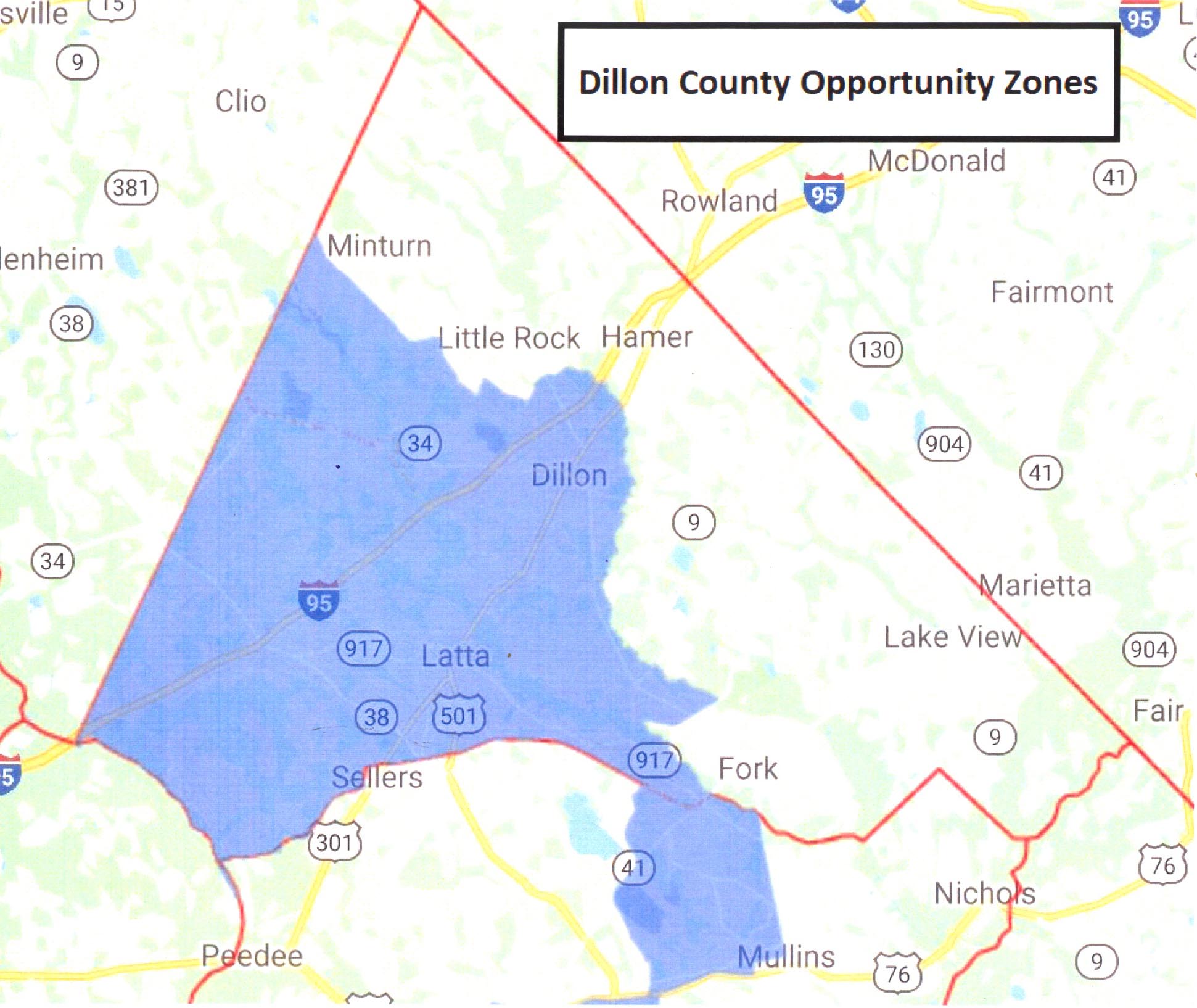

Opportunity zones are census tracts in economically distressed communities. Opportunity Zones came about through the 2017 Tax Cuts and Jobs Act.

In South Carolina, nominations were submitted to the governor who used a formula to equitably identify qualifying tracts. The Governor’s office sent the nominations to the Department of the Treasury who validated and named the Opportunity Zones. The zones had to meet certain requirements. The census tracts had to have a poverty rate of at least 20 percent or a median family income of no more than 80 percent of the statewide median family income.

South Carolina has 135 Opportunity Zones. Each county in the state has at least one opportunity zone, and there are no more than two opportunity zones in every county. Once the opportunity zones are designated, they cannot be changed.

McLean said there are 8,000+ opportunity zones across the United States. She said there is a great deal of competition for projects going into opportunity zones.

Opportunity zones are an conomic development tool. Opportunity zones are designed to spur private economic development and job creation in distressed communities. Opportunity zones provide tax breaks and incentives to investors who reinvest their capital gains in a qualified opportunity zone fund or a qualified opportunity zone business. She said this is all based on an investor with capital gains.

If an investor holds the funds or the business for five years, the investor gets a reduction on the tax liability on those capital gains by 10 percent.

If an investor holds the investment for 10 years, the tax liability reduces on the original funds by 15 percent and the investor doesn’t pay any taxes on the increase of the value of the investment. She said it is tax avoidance – a deferral and a reduction.

McLean said opportunity zones provide tax benefits to investors and encourages growth in economically distressed areas.

The most common projects are housing, hotels, commercial/office space, shopping centers, and retail space. She said the goal of opportunity zones was commercial and real estate growth.

McLean explained that an investor puts money in a qualified opportunity fund. The fund makes investments in businesses and real estate in an actual opportunity zone. These qualified opportunity funds must invest at least 90 percent of their funds in into an opportunity fund, McLean said. Funds do not have to be invested locally. They can be invested in any opportunity zone in any part of the country. “If they invest in South Carolina, that’s a homegrown benefit,” McLean said.

McLean said opportunities can be a valuable tool to communities so commerce is providing information to communities.

McLean said the state can help communities develop a prospectus/marketing piece. They have also revamped their website, www.scopportunityzone.com.

McLean said the hope that opportunity zone benefits coupled with other programs will make an attractive investment package.